The ICO craze marked a pivotal moment in cryptocurrency, characterized by rapid fundraising and rampant speculation. ICOs allowed entrepreneurs to bypass stringent securities laws, raising capital through global token sales without traditional KYC and AML protocols. The ERC-20 token standard facilitated the creation and exchange of tokens, leading to a surge in both legitimate and fraudulent projects. Investors hoped to buy low during ICOs and sell high once tokens hit exchanges.

However, many tokens lacked intrinsic value, leading to price collapses. Misaligned incentives saw token issuers focused on initial capital rather than delivering on promises, while investors were driven by speculative gains. Regulatory scrutiny from the SEC highlighted the lack of investor protections and widespread fraud, leading to many ICOs being deemed illegal and further market decline.

This period underscored the need for sustainable fundraising mechanisms, paving the way for innovations like Augmented Bonding Curves. These aim to create more stable and transparent financial ecosystems, balancing the interests of all stakeholders and ensuring long-term project viability and investor protection.

Solving the ICO Problems with Bonding Curves

The ICO boom and bust highlighted significant issues in token liquidity and investor incentives. Bonding curves offer solution to these problems by providing a structured mechanism for token issuance and trading.

When investors buy tokens, the smart contract mints new tokens and determines their price. Conversely, when investors want to sell, the smart contract buys back the tokens at a price based on the sell curve, which is typically lower than the buy curve to ensure liquidity. This system eliminated the need for external exchanges and guarantees that investors can buy and sell tokens with predictable pricing. By ensuring liquidity and reducing the potential for pumps and dump schems, bonding curves create a more stable and trustworthy environment for token projects.

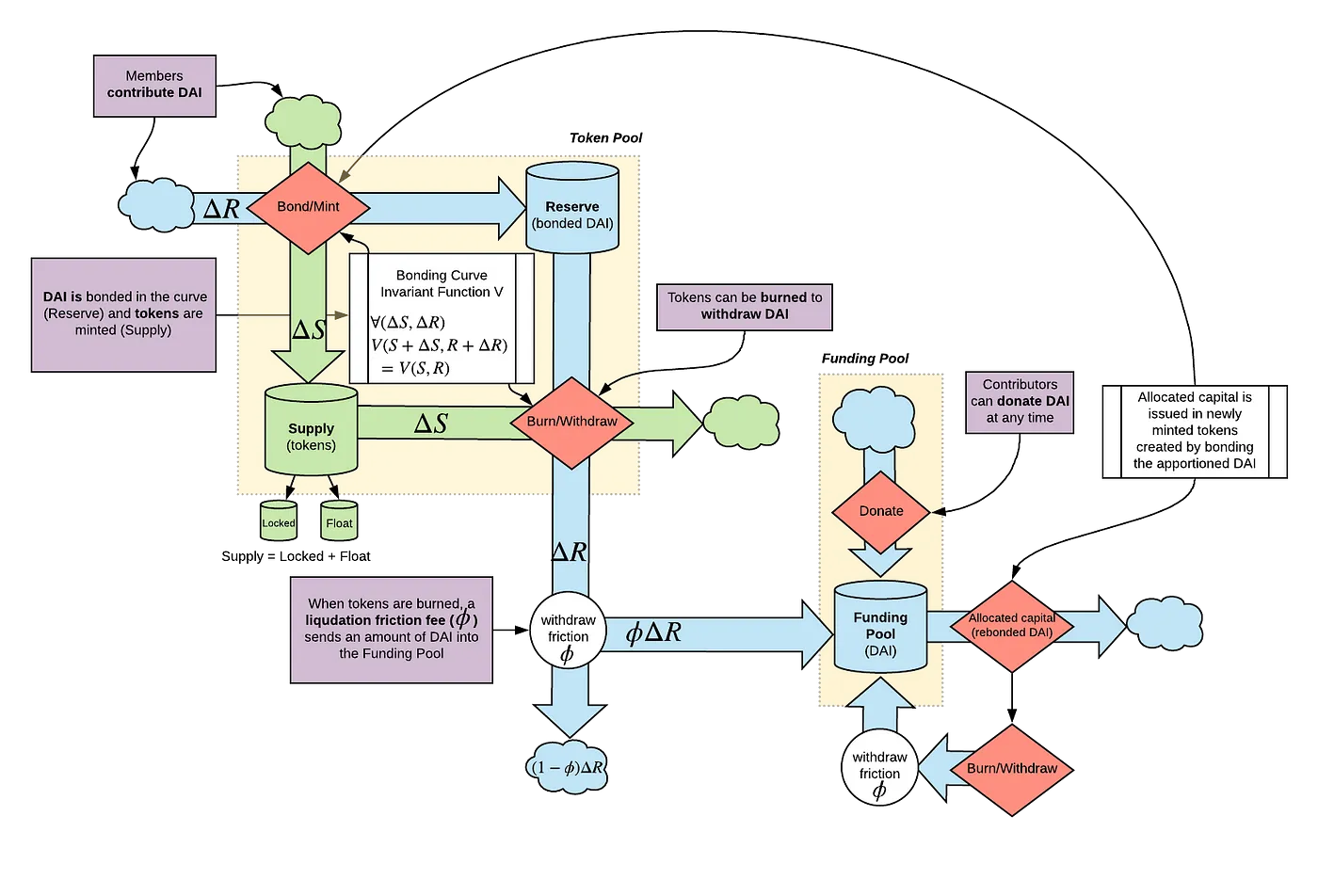

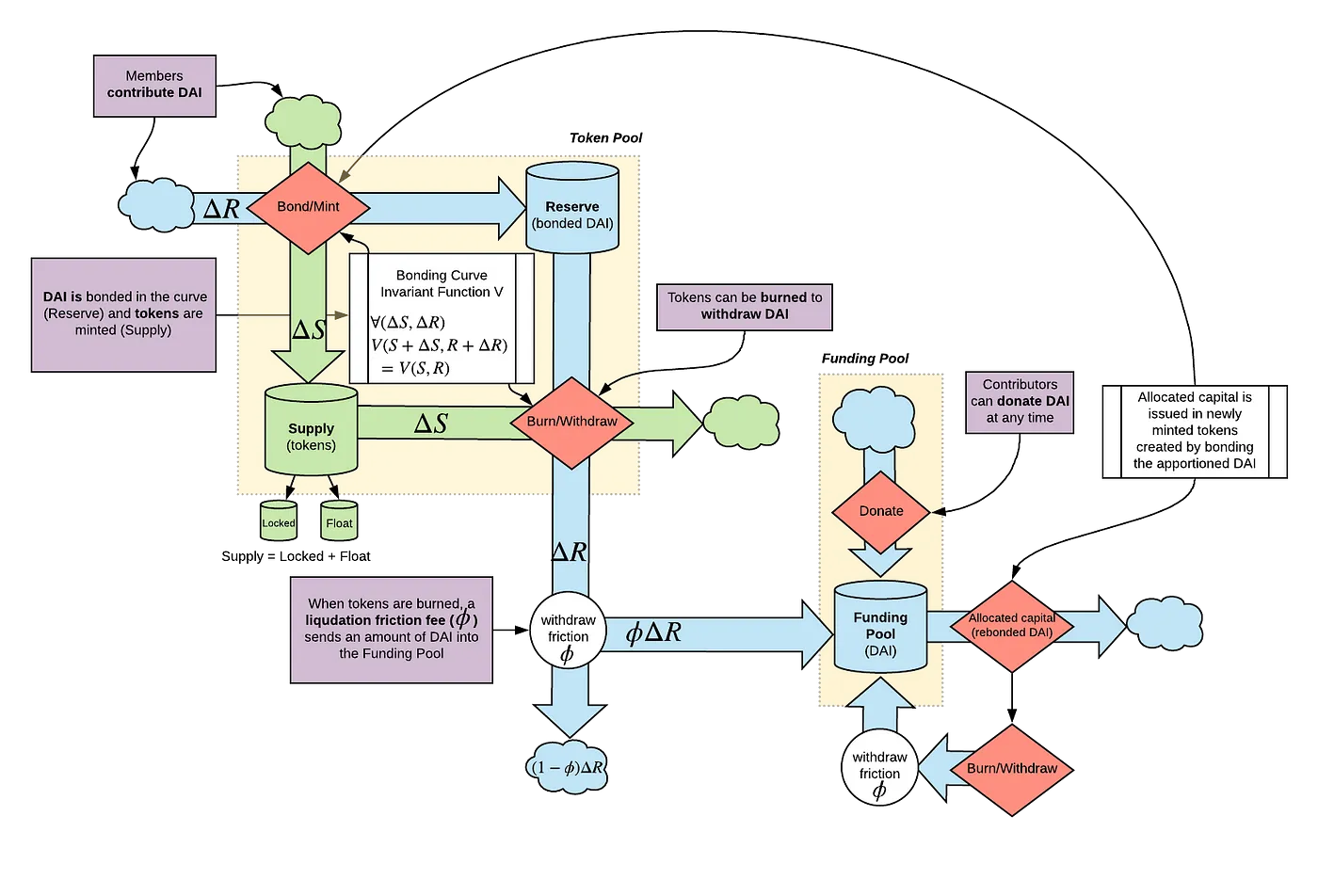

The Augmented Bonding Curve (ABC) is following the evolution of token issuance strategies. The Augmented Bonding Curve (ABC) aims to expand the design space of the bonding curve by ensuring liquidity and aligning incentives for all participants. The design can be conceptualized as a standard bonding curve where reserve pool is augmented with a funding pool , a token lock-up/vesting mechanism, and inter-system feedback loops. The commons pool which is funded by fees generated from the minting and burning of tokens during user interactions with the bonding curve. This commons pool serves as a collective resource that supports the project's sustainability and growth. Every time a user buys or sells tokens through the bonding curve, a small fee is extracted and added to this pool. These accumulated funds can then be utilized for various purposes, such as further development, community initiatives, or other project-related expenses.

System diagram for an Augmented Bonding Curve System

During the Hatch Phase initial contributors (i.e. founding members of the organization, devoted contributors, initial investors or “Hatchers”) participate in a hatch sale.** The point of this phase is to gather contributors and pool capital — in our system we use xDAI - to bootstrap their Commons by funding an initial goal. A percentage is put into the Reserve Pool and “bonded” to the curve (i.e. minting tokens and determining the initial spot price used during the Open Phase) and a percentage is put into the Funding Pool. The capital in the Funding Pool remains un-bonded as a floating source of capital that can be distributed as real capital outside of the bonding curve.